FDIC and SIPC insurance are both ways to protect your assets. FDIC insurance protects you in the event that your bank fails, and SIPC insurance protects you in the event that your brokerage firm fails. These forms of insurance operate very differently, however. Let’s take a deeper look at these two types of insurance and what they cover.

FDIC vs SIPC insurance: Is your money safe?

Table of Contents

Protect your account with up to $100 million in supplemental insurance

Our dedicated account managers will help you find the best plan for your needs.

Differences Between FDIC and SIPC

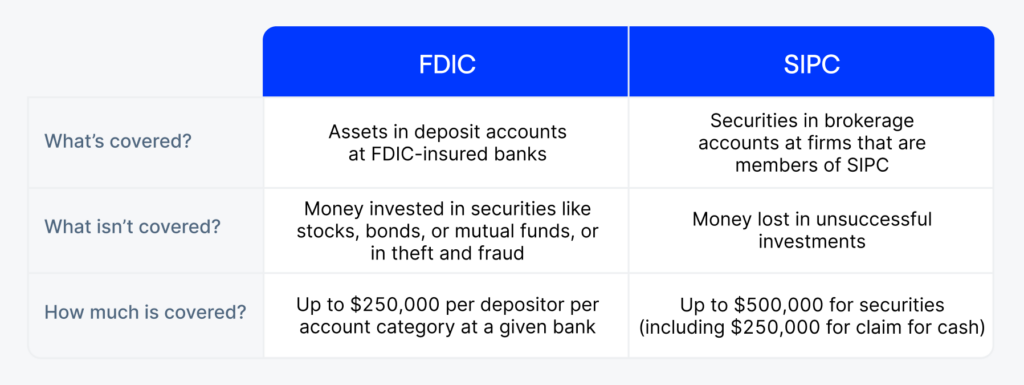

Simply put, while FDIC insurance covers assets stored in a bank account, SIPC insurance covers securities held in an applicable brokerage account.

The Federal Deposit Insurance Corporation (FDIC) is a government agency that protects deposit accounts. The Securities Investor Protection Corporation (SIPC), meanwhile, is a nonprofit membership corporation that covers investors if a firm fails.

While these bodies both aim to protect assets, they do not protect the same type or amount of assets. Let’s look at a breakdown of the differences between FDIC and SIPC insurance:

Differences between FDIC and SIPC insurance

| FDIC | SIPC | |

|---|---|---|

| Type of Assets Covered | Assets in deposit accounts at FDIC-insured banks | Securities in brokerage accounts at firms that are members of SIPC |

| Type of Assets Not Covered | Money invested in securities like stocks, bonds, or mutual funds, or in theft and fraud | Money lost in unsuccessful investments |

| Coverage Limit | Up to $250,000 per depositor per account category at a given bank | Up to $500,000 for securities (including $250,000 for claims for cash) |

| When Insurance is Applied | When a bank fails | When brokerage firms become insolvent |

| How it Works | Account holders receive money if their bank closes | Account holders are compensated according to what securities they own at the failed firm |

| How to Reclaim Money | Call 1-877-275-3342 or file a claim on the FDIC website | File a claim form before the deadline (available online and mailed to eligible account holders, with more information on SIPC.org) |

| Other Key Differences | Actively seeks out claims in addition to waiting for customers to file | Securities are returned to customer, or funds are offered that can be used to purchase replacements |

Sources: FDIC, SIPC, SIPC – How it works

What is FDIC insurance?

The FDIC, or Federal Deposit Insurance Corporation, is a federal agency that was created during the Great Depression to protect bank deposit accounts in the event of bank failures. If a financial institution becomes insolvent, the FDIC ensures that customers can recover funds up to stated amounts.

FDIC Eligibility

The FDIC covers money stored in deposit accounts up to $250,000. Some retirement accounts are also covered up to $250,000. The FDIC limit applies per depositor, per bank and per account category.

Eligible Assets

A wide range of deposit accounts are covered by the FDIC, including (but not exclusive to):

- Checking Accounts

- Savings Accounts

- Retirement accounts like IRAs

- Certificates of Deposit

- Cashier’s checks

Ineligible Assets

FDIC insurance coverage does not extend to all assets. Here are a number of common securities and assets not covered by the FDIC:

- Accounts at credit unions, which are instead covered by the NCUA (National Credit Union Administration)

- Stocks

- Bonds

- Mutual Funds

- Life Insurance Policies

- Annuities

How to know if an account is FDIC-insured

A deposit account held at a member-FDIC bank is covered up to the FDIC insurance limit of $250,000 per depositor at each bank and within each account type. Your bank should tell you if it is a member of the FDIC.

This means that, if you hold two accounts of the same type at the same bank (such as two checking accounts) only one can be FDIC-insured. But if these are held in two separate member banks, they can each be insured. Joint accounts are insured up to $250,000 per person, or $500,000 total.

Example:

You have $300,000 in assets. If you keep it all in a checking account at Bank A, it will be insured up to $250,000. But if you put $250,000 in Bank A and $50,000 in Bank B, you’ll be covered for the full $300,000.

Not every account at a bank is FDIC-insured. If you hold several accounts at one financial institution, check with the bank about the FDIC status of each account.

Protect your account with up to $100 million in supplemental insurance

Our dedicated account managers will help you find the best plan for your needs.

What is SIPC insurance?

The SIPC, or Securities Investor Protection Corporation, is a nonprofit corporation created by the Securities Investor Protection Act of 1970. The SIPC protects assets stored in brokerage accounts and oversees the liquidation of broker-dealers who undergo bankruptcy or otherwise lose customer assets.

Did you know?

The SIPC is not a government agency, but rather a private body created by federal mandate.

SIPC Eligibility

The SIPC does not protect customers from all losses in a brokerage account. Let’s look at the types of assets eligible for SIPC coverage.

Eligible Assets

a) Securities purchased at brokerage firms, including:

- Stocks

- Bonds

- Mutual funds and money market mutual funds

- Treasury securities

- Certificates of Deposit

b) Cash stored with a brokerage in order to purchase securities

Ineligible Assets

Some assets aren’t eligible for SIPC coverage. These include:

- Securities and money stored at a brokerage that is not an SIPC member

- Money lost due to market risk, volatility, or misguided investment choices

SIPC coverage also has a limit of $500,000 per account, with a maximum of $250,000 for cash. If you’re looking for additional coverage, please contact Public’s member support.

How to know if an account is SIPC-insured

For an account at a brokerage to be insured by the SIPC, the firm itself must be an SIPC member.

If you have an investment account at an SIPC-insured brokerage, it is covered up to the $500,000 limit. If you have accounts at multiple SIPC-insured firms, each one is covered up to the limit.

The Securities and Exchange Commission notifies the SIPC when a brokerage fails, activating SIPC coverage.

Did you know?

Public is a member of SIPC, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash).

*Explanatory brochure available upon request or at www.sipc.org..

What about assets above the SIPC limit?

If you have an account balance exceeding this limit, you can add supplemental insurance up to $100 million on Public. Our dedicated account managers can help create your personalized plan.

How to make sure your money is safe

SIPC and FDIC insurance are protections that ensure that your money is safe in the event of insolvent or bankrupt institutions. Together, they defend you against potential insolvency of the institutions where you hold your money or invest.

Both SIPC and FDIC insurance come with limits in terms of the amount and types of assets they cover, as well as the situations that cause them to kick in.

Public is a member of SIPC. As a Public customer, securities in your account are protected up to $500,000. For details, please see www.sipc.org. However, if you have an account with significant value, you may be able to supplement these built-in protections with additional coverage based on your needs.

If you’re looking for additional coverage for your Public account, it’s easy to sign up:

-

Understand what supplemental insurance covers Supplementary coverage protects against the potential loss of cash and securities, such as stocks and Treasuries, in the unlikely event that Public fails financially or cannot fulfill its member obligations. It doesn’t cover losses caused by market fluctuations.

-

Talk with our dedicated support Our customer experience team is standing by to help and can connect you with a dedicated account manager.

-

Create your personalized plan Your account manager can walk through your options and find the right insurance plan for you.

Protect your account with up to $100 million in supplemental insurance

Our dedicated account managers will help you find the best plan for your needs.

Frequently Asked Questions

What is the difference between FDIC and SIPC insurance?

While the FDIC insures money stored in a bank account, the SIPC insures assets stored in a brokerage account.

Can a brokerage account be fdic and sipc insured?

The FDIC only insures money in deposit accounts. Money or investments in a brokerage account are instead SPIC-insured.

How much does FDIC insure?

The FDIC insures up to $250,000 per depositor at a given bank and in a given type of account.